20 Business Deduction For 2025 - Deductions For Business Expenses 2025 Elane Harriet, This means eligible businesses will be able to receive a bonus 20% tax deduction for spending that supports more efficient energy use. The bonus 20% deduction for eligible expenditure under the skills boost and/or the technology boost will be available where a small business (with aggregated turnover less than $50 million). Enacted via the tax cuts and jobs act of 2025, the qualified business income deduction, or qbi, is worth up to 20% of eligible revenue, subject to limitations.

Deductions For Business Expenses 2025 Elane Harriet, This means eligible businesses will be able to receive a bonus 20% tax deduction for spending that supports more efficient energy use.

25 Small Business Tax Deductions (2025), $20,000 threshold from 1 july 2023 to 30 june 2025 (no extension to medium sized businesses) and revert to $1,000 from 1 july 2025;

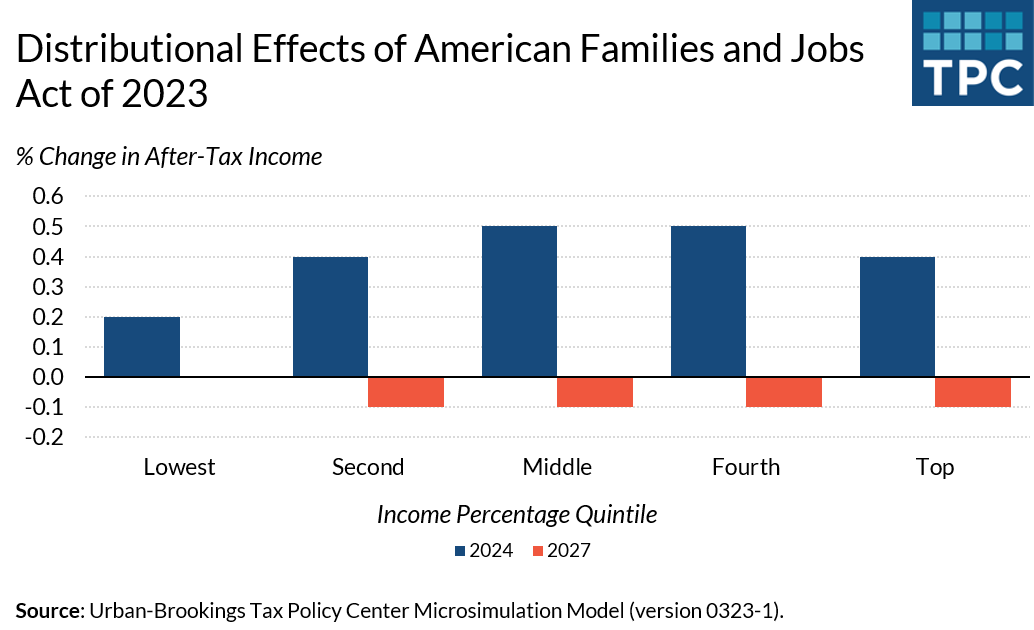

Tax Policy Center on Twitter "A House GOP tax plan would raise the, Available for businesses with an aggregated annual turnover of less than $50 million, it.

Top 20 Business Deduction Guide for Small Businesses CARICHAM, Restoring 100% bonus depreciation to boost capital.

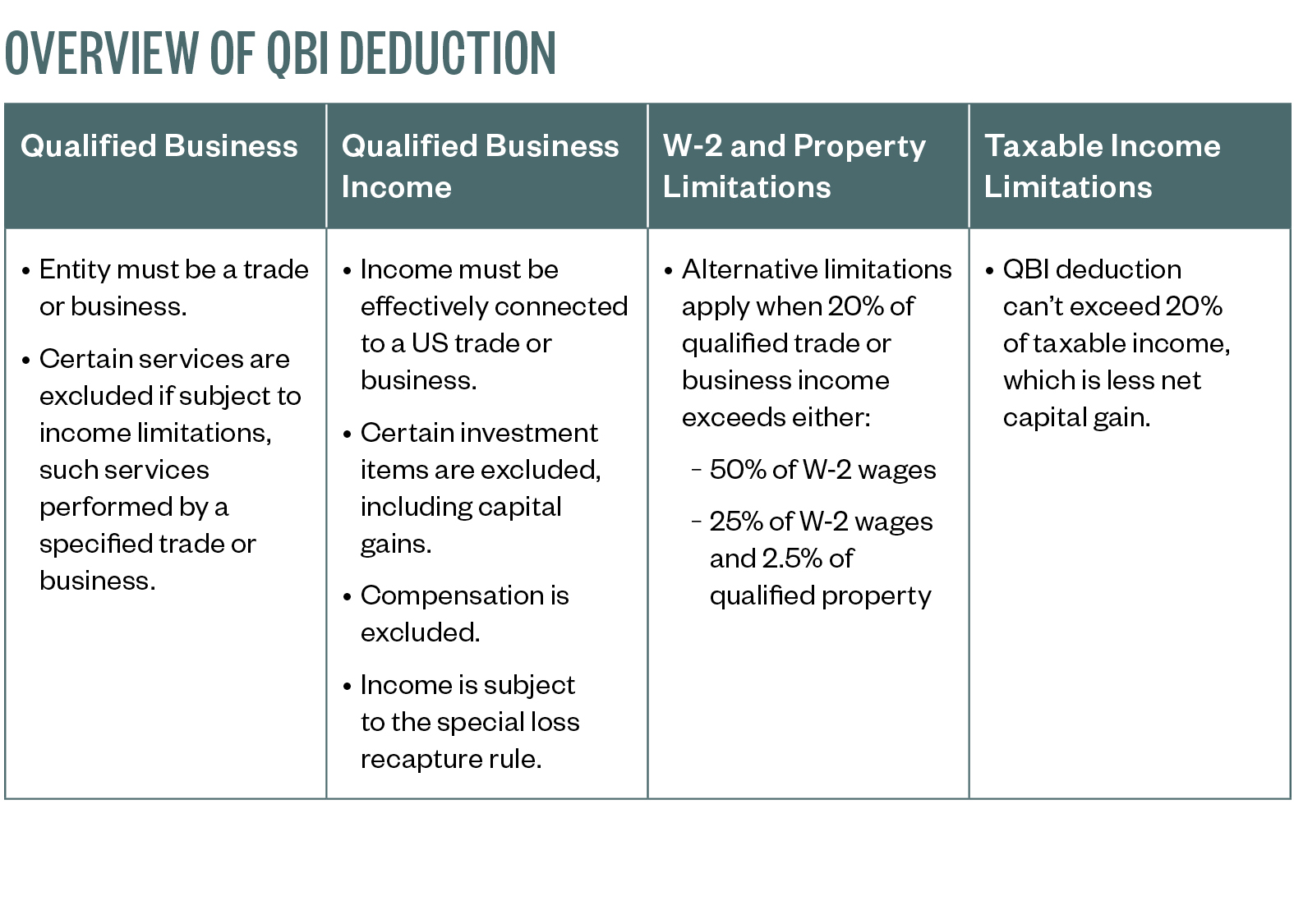

New Qualified Business Deduction, Qualified business interest (qbi) deduction:

Business Use Of Home Deduction 2025 Fayre Jenilee, The qualified business income (qbi) deduction allows certain business owners to deduct up to 20% of their qbi.

Qualified Business Deduction 2025 2025, This deduction began in 2025 and is scheduled to last through.

20 Business Deduction For 2025. Qualified business interest (qbi) deduction: This deduction allows eligible small business owners to reduce their taxable income by 20%, meaning less.

Deductions For Business Expenses 2025 Elane Harriet, Find out what's available and what it means for your business.

Federal Standard Deduction For Tax Year 2025 Grata Mathilde, Small businesses with an aggregated annual turnover of less than $50 million will be allowed an additional 20% tax deduction to support their digital operations and digitise their.